Which sectors will benefit from GST council’s new reforms?

Deprecated: htmlspecialchars(): Passing null to parameter #1 ($string) of type string is deprecated in /home/nqtjeubh/public_html/wp-includes/formatting.php on line 4724

Check full list.

India’s GST Council has rolled out one of the most important tax updates in years. The reforms are designed to make GST simpler and fairer, cut the tax burden on many everyday items, and tighten rates on luxury or harmful goods. They come into effect from 22 September 2025 (with some changes being retrospective or phased). Below I explain — in simple, friendly language — which sectors gain, why they gain, and what concrete changes to watch for. Goods and Services Tax Council+1

Quick headline summary (one line)

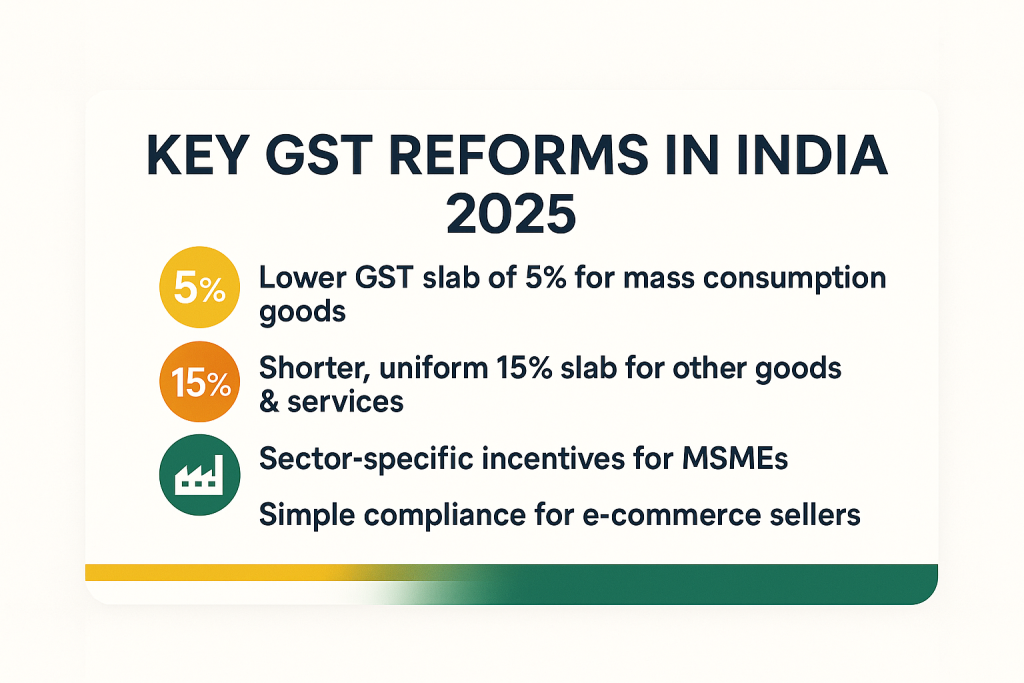

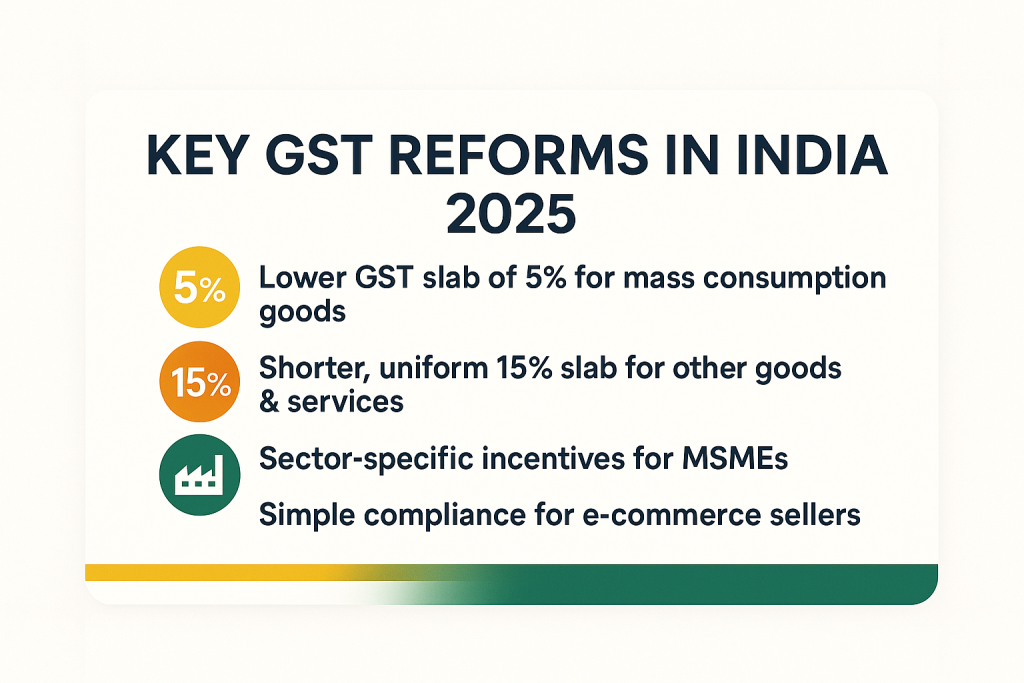

GST 2.0 reduces complexity by moving most goods and services into two main slabs (5% and 18%), introduces a higher 40% rate for certain luxury/sin goods, and adjusts rules on input tax credit and some compliance steps — benefiting consumers, MSMEs, farmers and key everyday sectors. Press Information Bureau+1

The big changes you should know (short list)

- Two main tax slabs: 5% (essentials) and 18% (most other goods/services). Press Information Bureau

- 40% demerit rate for specified luxury/sin goods (tobacco, some aerated drinks, high-end luxury items). Press Information Bureau

- Some compensation cess changes (subsumed into new GST rates for many items; limited continuation for tobacco/pan masala until liabilities are cleared). VJM Global+1

- Procedure & compliance tweaks and new clarifications on Input Tax Credit (ITC) for some services. IRIS GST+1

Who benefits — plain list

The Council and government statements explicitly say these groups will gain directly or indirectly:

- Common households / consumers (lower tax on many essentials). Press Information Bureau

- Food & FMCG (many staples moved to lower slab). The Economic Times+1

- Housing and construction (materials or certain housing-related items getting relief). The Economic Times

- Healthcare and education (clarifications and relief on many items/services). The Economic Times

- MSMEs and small traders (simpler rates, reduced compliance burden in some cases). Lawrbit

- Agriculture and farmers (lower tax on several agri inputs / processed foods). Press Information Bureau

- Auto & mobility — mixed: some segments cheaper (small cars, certain two-wheelers), while luxury/very high-end vehicles face higher demerit tax. VJM Global+1

At the same time, “sin” categories and high luxury items will see higher effective taxation (to protect revenue and public health). Press Information Bureau

Handy table: sector → what changes → how they benefit (or not)

| Sector | What changed (high level) | How it helps / hurts | When it kicks in |

|---|---|---|---|

| Food & FMCG (milk, ghee, cheese, staples) | Many everyday food items moved to lower 5% or clarified as essential | Lower retail prices; quicker demand recovery; better affordability for households (example: dairy producers passing on cuts). | Effective 22 Sep 2025 (some retrospective adjustments possible). The Times of India+1 |

| Housing & Construction (bricks, cement, basic materials) | Rate rationalisation for basic building materials and housing-related supplies | Cheaper construction costs; may help affordable housing and homebuyers | Mostly effective 22 Sep 2025. The Economic Times |

| Healthcare & Pharma | Clarifications on rates, exemptions for some essential medicines/services | Lower out-of-pocket costs for patients; less tax burden on supply chains | Effective dates vary; many from 22 Sep 2025. The Economic Times |

| Education & Training | Certain educational supplies/services clarified or eased | Reduced costs for books/supplies, clearer treatment for tuition/services | Effective 22 Sep 2025 (check sector-specific notifications). The Economic Times |

| MSMEs & Traders | Simpler two-slab structure + procedural reliefs | Easier compliance, fewer rate categories to manage, lower working capital stress | Procedural rules effective 22 Sep 2025; some compliance rules phased. Lawrbit |

| Agriculture & Food Processing | Lower rates on many processed staples, inputs adjustments | Boost for agri processors, better farm incomes via higher demand | Effective 22 Sep 2025 (some items retro from Apr 1, 2025 as noted). Press Information Bureau |

| Automobile & Mobility | Small cars/essential vehicles may see relief; luxury/high-end cars face steeper 40% demerit tax | Mass-market vehicles become more affordable; luxury car demand may compress | Effective 22 Sep 2025; compensation cess rules adjusted. VJM Global+1 |

| Luxury / Sin Goods (tobacco, some aerated drinks, pan masala) | Higher GST rate of 40% or continued cess until liabilities cleared | Higher prices aimed at public health and revenue; demand may fall | Effective 22 Sep 2025 (some cess rules continue). Press Information Bureau+1 |

| Services (transport, rentals, hotels) | New rate clarifications; some services get special ITC limits/conditions | Possible lower consumer prices for eligible services; businesses must check ITC rules | Notifications from CBIC; many apply from 22 Sep 2025; some ITC rules vary. A2ztaccorp+1 |

(This table summarises the main, widely-reported effects. Businesses should check official CBIC/GST Council notifications for item-level details.) Goods and Services Tax Council

Real examples (to make it concrete)

- Dairy: After rate cuts were announced, Amul announced price reductions across many products (but companies decide pass-through amounts). This shows how lower GST on food can quickly move to retail prices. The Times of India+1

- Cars: Small economy cars have had compensation cess removed in some cases — making entry-level cars relatively more affordable — while luxury cars are taxed heavily to protect revenue and curb excess consumption. VJM Global

SEO-friendly tips for your blog (short, practical)

- Primary keyword: “GST Council new reforms 2025” — use it in title, first paragraph and meta description.

- Secondary keywords: “GST 2.0”, “GST slab changes 2025”, “which sectors benefit from GST reforms”, “GST effects on food and automobile”. Sprinkle naturally.

- Use headings & a table: Google likes clear structure — include the table you asked for (done above).

- Short paragraphs & bullets: Keeps readers engaged and reduces bounce rate.

- Internal links: Link to your site’s related posts like “How GST affects small businesses” or “Price changes after GST cuts” to improve SEO.

- Authoritative external links: Link to PIB, CBIC or Economic Times for credibility (but avoid linking to banned outlets you mentioned earlier). I’ve used PIB, Economic Times, Hindustan Times, ClearTax and CBIC-related writeups as sources. A2ztaccorp+4Goods and Services Tax Council+4The Economic Times+4

What businesses and consumers should do next (practical checklist)

- Consumers: Watch product prices — essentials may get cheaper; for big purchases (cars, appliances) compare final on-road prices. The Times of India

- Retailers & FMCG firms: Update your pricing models quickly and communicate any price drops to customers. Plan inventory and promotions around the effective date. ClearTax

- MSMEs / Traders: Simplify your GST filings to the new slabs; consult your CA about any procedural reliefs or threshold changes. Lawrbit

- Service providers: Check new CBIC notifications for ITC restrictions (some services now have special ITC rules). Update accounting and billing software accordingly. A2ztaccorp

- Accountants & CAs: Read the official notifications and the PIB/GST Council press release carefully — item-level changes matter. Help clients with reclassification where needed. Goods and Services Tax Council

The GST Council’s Next-Gen reforms are a big move toward making taxes simpler and easing the load on everyday expenses. If you buy food, build a home, run a small shop, or work in health or education — you’ll likely see benefits. Luxury and harmful items are being taxed more — that’s intentional. The key for businesses is to act fast: update prices, check Input Tax Credit rules, and communicate clearly with customers. For readers, watch your daily bills — you may find some pleasant surprises at the checkout from 22 September 2025 onwards. Press Information Bureau+1

Deprecated: htmlspecialchars(): Passing null to parameter #1 ($string) of type string is deprecated in /home/nqtjeubh/public_html/wp-includes/formatting.php on line 4724